EOW closing BTC price: $64,953

Date range: April 15 - April 21, 2024

In this report:

- A $100,000 Spotlight on the Halving

- Skeptical Views Persist Among "The Usual Suspects"

- Is the Halving Priced In?

Weekly Snapshot

Main Topics of the Week

A $100,000 Spotlight on the Halving

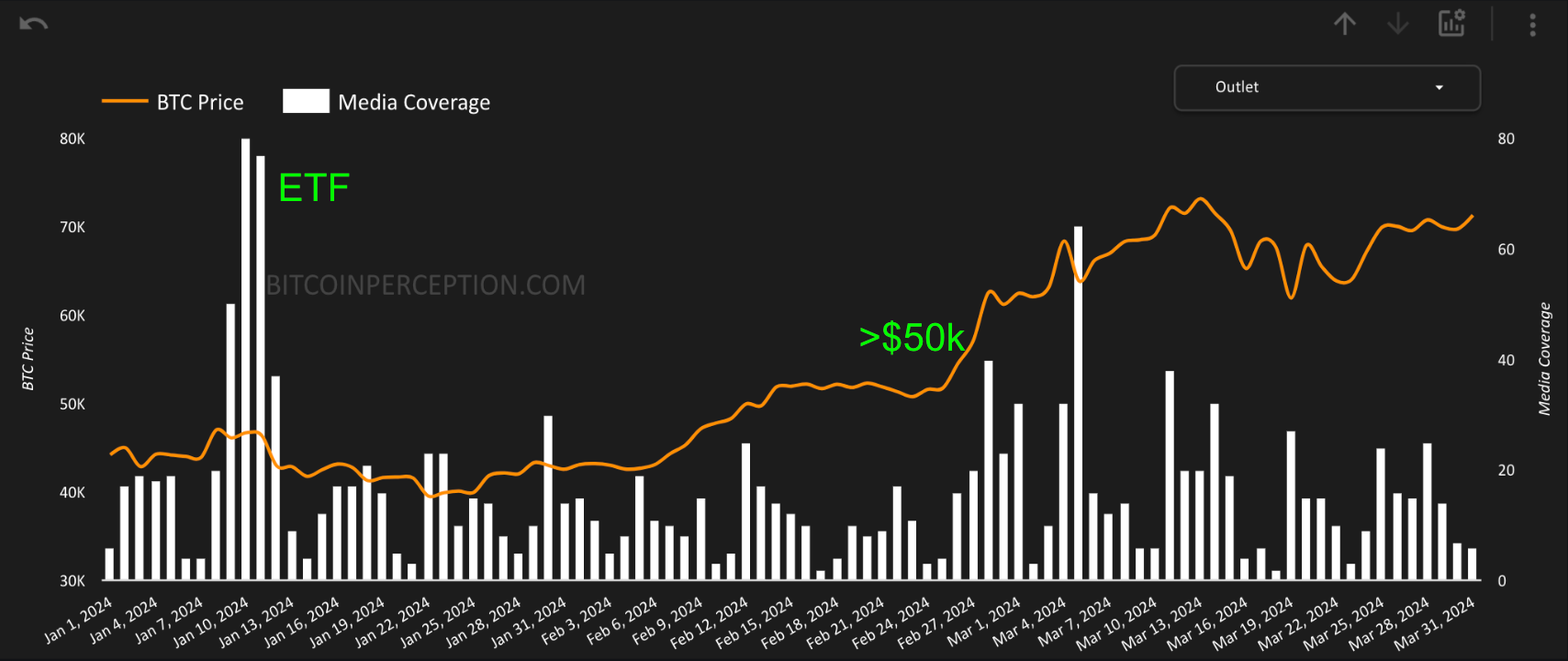

Last week, the media spotlight was intensely focused on Bitcoin's halving event, attracting unprecedented coverage despite a downtrend in Bitcoin's price.

Mainstream media's coverage of The Halving is intensifying.

— Bitcoin Perception 🗞️ 📊 (@BTCPerception) April 18, 2024

Sentiment is 18% negative, 35% positive and 47% balanced. pic.twitter.com/Y8Bv0Uwvm7

Notably, despite the price dip, major outlets remained optimistic, projecting a target price of $100,000, which seems to be the next big catalyst for coverage, just like $50,000 was.

Jack Denton of Barron's explains:

"The halving is a change to Bitcoin’s programmatic monetary policy that will cut issuance of new tokens in half, restricting supply and boosting prices as long as demand holds steady or increases."

On CNBC's Squawk Box, Anthony Pompliano discussed the halving's potential to drive prices above $100,000 within the next 12-18 months. Watch here.

Matt Hougan of Bitwise added that "Bitcoin prices are poised for a significant rally post-halving," aligning with the optimistic outlook. Watch here.

Skeptical Views Persist Among "The Usual Suspects"

Despite overall bullish sentiment, some traditional media outlets (let's call them the usual suspects) remained skeptical.

Time Magazine's Andrew R. Chow highlighted the economic circumstances of this halving, suggesting that the anticipated price surge might not occur due to traders "selling the news." He cited JP Morgan's February prediction, which suggested a potential fallback to $42,000 post-halving.

The Financial Times' Philip Stafford discussed the growing importance of transaction fees for Bitcoin’s sustainability, hinting at potential operational challenges as mining rewards diminish.

Is the Halving Priced In?

I've previously said that the Halving is this strange cultural phenomenon in which people relentlessly try to argue it is priced in and it ends up never being priced in, over and over again, every four years.

But let's see how other folks think differently:

Bloomberg's María Paula Mijares Torres reported that analysts from JP Morgan and Deutsche Bank see the halving as largely priced in, while Nic Carter from Castle Island Ventures argued on Bloomberg Markets that the halving should be considered priced in, as well.

In-depth and educational coverage came from Reuters' Elizabeth Howcroft, FT's Scott Chipolina, and Bloomberg's David Pan, who all provided valuable insights into the halving's implications.

Post-Halving Thoughts To Start The Week

Happy this is over, frankly.

What felt like 90% of the mainstream media's coverage of Bitcoin last week:

Following the intense anticipation, the actual halving event occurred at block 840,000, yet post-halving coverage was notably subdued with only CNBC and Barron's covering it.

This quiet aftermath might suggest a shifting focus in mainstream media coverage, hopefully indicating a broader movement away from speculative reporting to more substantive discussions on Bitcoin's integration into financial systems and its broader economic impacts.

See you next week.